Soku Swap

Soku Swap (DEX)

What is Soku Swap?

Soku Swap is a fully decentralized cryptocurrency exchange that uses a relatively new type of trading model called an automated liquidity protocol. Soku Swap operates on the Ethereum network as well as the Binance smart chain.

Soku Swap is a decentralized exchange. Blockchain technology allows cryptocurrency to be able to store multiple transactions in a database, making it transparent, secure, and unable to be edited or intervened by any party. This is the reason blockchain technology is used by many cryptocurrencies today. It uses an automated market maker smart contract to create a liquidity pool. The exchange is live on ERC-20 tokens and Network BEP-20 tokens.

Soku Swap is a fully decentralized cryptocurrency exchange that uses a relatively new type of trading model called an automated liquidity protocol. Soku Swap operates on the Ethereum network as well as the Binance smart chain.

Soku Swap is a decentralized exchange (DEX) hosted on the Ethereum network and the Binance smart chain. DEX uses automated smart contracts from market makers to create a liquidity pool for ERC-20 tokens and BEP-20 tokens. These features allow users to trade using algorithms rather than the order books used on conventional exchanges.

Knowing that the biggest obstacle to entry was a lack of education and knowledge about how to trade cryptocurrency, they decided to focus on it. With an on-screen chat feature to answer any questions you may have and step-by-step instructions on the screen, anyone can trade. And if you still want to know more, they have classes you can complete for a fee in crypto. You can even get paid to send people to class.

Soku Swap also has several advantages, such as allowing users to make decisions about the future of DEX using our governance token. And we even have weekly payments for everyone who has placed liquidity and made 3 trades per week.

What is Soku Swap?

Soku Swap is a decentralized exchange (DEX) hosted on the Ethereum Network and the Binance Smart Chain. DEX uses automated market maker smart contracts to create a liquidity pool from ERC-20 tokens and BEP-20 tokens. Its features allow users to trade using an algorithm versus the order book used on conventional exchanges.

The platform is designed to be easy to use, supports privacy, lowers fuel costs. Soku Swap is designed for traders and performs very well like any other smart contract component that requires guaranteed on-chain liquidity.

Soku Swap feature

- Soku Swap offers users a variety of ways to make money. From providing liquidity to trading or taking advantage of arbitrage using flash loans. Imagine doing arbitrage trading with Pancake Swap or Uniswap for Millions of Dollars using our coins in our easy-to-use Flash Loan System.

- With SOKU, our governance token, you can help define the future of the exchange. And if you make a few trades each week, you will also get a fraction of the trading volume. The more the exchange grows, the bigger your payout will be. In addition, you can make decisions about what service should come first. If you store a sufficient amount of SOKU, we may need to provide parking space on your behalf.

- At Soku Swap, you can trade on the Ethereum Network and the Binance Smart Chain. Ethereum is the largest decentralized network in the blockchain world, it is impossible to run an exchange without using it. But along with size, other problems arise. Binance Smart Chain came out recently and is helping out with that problem. With faster trading and lower fees, Binance is definitely one to watch out for. We feel both are important and want to make sure our users have the option to trade wherever they want.

- Have you ever tried explaining crypto to someone? I'm sure you know, we all do. We know it's a headache, but we try to educate the people we know because we care for them. Imagine if you could send them links to some free crypto classes, and the more classes they do, the more you will get both. And don't worry, we'll keep it short and fun. We want to make learning easy and profitable for everyone.

- Centralized exchanges require all customers to fill out a form that identifies themselves. You will need to provide your name, date of birth, Jamsostek, blood type, DNA sample, etc. You see what I mean. Crypto was born as a decentralized currency that cannot be controlled and monitored. With DEX freedom, you just have to connect your wallet and make a trade.

What is a Decentralized Exchange (DEX)?

A decentralized exchange is a type of cryptocurrency exchange that allows direct peer-to-peer digital currency transactions to be carried out online securely and without the need for intermediaries.

Advantages of DEX

- No KYC - KYC / AML compliance is the norm on many exchanges. For regulatory reasons, individuals must frequently submit identity documentation and proof of address. This is a privacy issue for some and an accessibility issue for others. What if you don't have valid documents? What if the information gets leaked? Since DEX is unlicensed, no one checks your identity. All you need is a cryptocurrency wallet.

- No Counterparty Risk - The main attraction of decentralized cryptocurrency exchanges is that they don't hold customer funds.

- Unlisted Tokens - Tokens that are not listed on a centralized exchange can still be traded freely on DEX, provided there is supply and demand

How does it work?

This allows users to trade using an algorithm versus the order book used on conventional exchanges. Price is determined using the formula x * y = k ( x coins tokens x and y coin token Y , and always maintain the invariant that x * y = k for some constant k), and this ensuring reserves remain in relative balance. Soku Swap reserves are pooled among the liquidity providers who supply the exchange with tokens in exchange for a portion of the transaction fees. Soku Swap uses registry contracts to facilitate exchange between different currencies. The system mechanics ensure trading between cryptocurrencies is based on their relative supply.

Liquidity token

The Soku Swap Liquidity Token (SOKU LP) represents the provider's contribution to the liquidity pool. These are ERC20 coins or BEP20 tokens depending on which chain they provide liquidity to. These tokens allow liquidity providers to sell or transfer their liquidity between accounts without affecting the liquidity in the pool.

Liquidity tokens are printed and sent to the address of the liquidity provider. They represent the provider's contribution to a base. These tokens are highly divisible and can be burned at any time to return a proportional market share to the vendor. The provider pays reserves and forms a new liquidity brand.

- The NBB sent to the function determines the number of liquidity tokens to be printed. The following formula calculates the number of embossed tokensMinted = totalAmount (bnbDeposited / bnbPool)

- Storing BNB in reserve also requires a deposit of a value equivalent to the BEP20 token. Stored tokens are calculated based on the formula tokensDeposited = tokenPool (bnbDeposited / bnbPool)

Tokenomik Soku Swap:

Name: SOKU

Base Price: $ 0.88

Blockchain: BSC

Total Token

Supply: 222,222,222 Symbol: SOKU

Total Tokens Available for Sale: 111,111,111

Type: BEP-20

Purchase Method: BNB, ETH, BTC,

USDT Softcap: 100,000 SOKU

Hardcap: 1,000,000

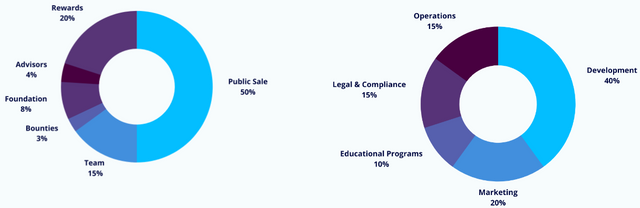

Token Distribution and Funding Allocation

All tokens sold during the pre-sale will be used for 30 days. You will receive SSoku tokens which can be exchanged for 1 SSoku token: 1 Soku token. You can exchange your SSoku tokens for Soku tokens via Soku Exchange after 30 days.

Soku can only be exchanged for Soku, no other tokens.

Read More Here:

Official Site: https://www.sokuswap.finance/

Twitter: https://twitter.com/SokuSwap

Telegram: https://t.me/sokuswap

Discord: https://discord.com/invite/DgNnfGWbd4

Facebook: https://www.facebook.com/Soku-Swap-102896308602496

Media: https://sokuswap.medium.com/

Username: Bambangfamungkas

Link: https://bitcointalk.org/index.php?action=profile;u=3122436

Komentar

Posting Komentar